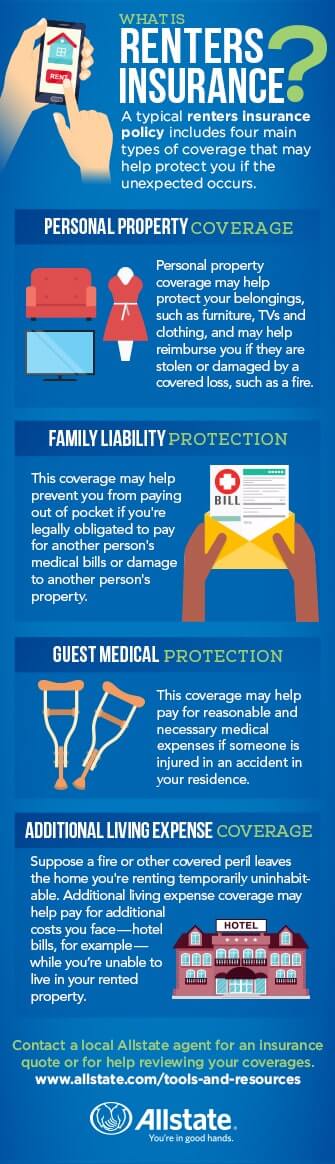

What Is Renters Insurance Coverage And Why Is It Important? Apollo Insurance Policy If your application is accepted, you can usually make your very first repayment and have coverage on the very same day. If you fall victim to identification burglary, we will help Business-use car insurance you in resolving the situation. You can make an application for compensation if you require to use lawful aid for preparing an investigation record, assisting in an initial examination or rejecting unlawful insurance claims, for instance. These lawful prices are hidden to EUR 2,000 with no deductible. We will certainly compensate for travel luggage loss and damages, such as theft and delay of baggage. One of the most usual deductible chosen by our clients for movable residential property is EUR 150. With a higher insurance deductible, you can obtain home insurance policy at a reduced expense, while a lower insurance deductible is valuable in instance of problems. At If, you can pay your insurance policy costs in 1, 2, 4 or 12 instalments, and the number of instalments has no effect on the price of your insurance policies. If you have major protected damage at home and need to temporarily remain somewhere else, we will additionally compensate costs sustained by that. Some common factors for responsibility claims include wrongful expulsions, failure to refund deposits, and not preserving the residential property leading to loss, damages, or injuries. This sort of insurance plan does not cover the property itself, as renters do not possess the building and can not cover it. Additional living expenditure insurance coverage covers additional prices of living incurred by an insurance policy holder that is briefly displaced from their place of residence. Plans commonly cover up to a restricted buck amount for clothing, furniture and electronic devices. And many proprietors call for occupants insurance coverage as an indirect way of screening potential renters. So exactly how, precisely, does renters insurance secure you, and why might your landlord require it under the terms of your lease? If you regularly rent your home, contact your insurance company about acquiring temporary rental insurance coverage. Landlords lug their very own insurance coverage to cover their rental residential or commercial properties in case catastrophe strikes. Nevertheless, several property manager insurance policies likewise include a relatively high insurance deductible, and filing claims typically result in a higher premium for property managers. It will add to fixings following substantial disasters that may take place on the residential property. If so, the idea of including another monthly expense isn't a really appealing choice. So it's very easy to reject occupants insurance coverage, thinking you do not have anything worth insuring to begin with. Les Masterson is a replacement editor and insurance expert at Forbes Advisor. He has actually been a journalist, reporter, editor and web content designer for greater than 25 years. He has covered insurance for a decade, including auto, home, life and health.

The Best Home and Auto Insurance Bundles of 2023 - Bob Vila

The Best Home and Auto Insurance Bundles of 2023.

Posted: Fri, 20 Jan 2023 08:00:00 GMT [source]

Worldwide Home Helsinki Uses Cookies

You won't not need to guarantee versus damages to the mobile home's framework. You would consist of that information on Row 9 of the Schedule E Supplemental Earnings and Loss type while submitting your tax obligations. The insurer will ask you to complete claim forms explaining the circumstance, and it might send a cases insurer to examine the case. An insurance deductible is the amount subtracted from an insurance coverage case check. The greater your deductible, the lower your property manager insurance coverage cost.- This is where the personal responsibility protection portion of occupants' insurance coverage comes in.Considerable home insurance will in addition cover any belongings and products broken during transport.Our customers can prove it, as 92% of them are satisfied or extremely completely satisfied with the processing of their cases.With home insurance, as a renter you can cover your belongings versus damage and vandalism as well as fire and water damages.Temporary living expenses, aka loss of usage coverage, assists pay the bill for any kind of extra costs you could sustain if you're required to evacuate your home for certain reasons.

Pick Your Sort Of Housing And Safeguard The Tenant's Products And Rental Flat

If you leave the range on and inadvertently start a fire or leave the water running and harm the floors and walls, the property manager or their insurance company might sue you. If you do not have insurance to shield yourself, you may end up with a substantial expense to foot. This is where the individual liability security section of occupants' insurance policy is available in. Without it, you won't get insurance policy money if your belongings are swiped or damaged in a fire or an additional trouble covered by mobile home tenants insurance policy. As an example, say a fire ignites and infects multiple systems within a building. In many cases, occupants could sue to demand that their property manager pay for problems to their personal property.Best Property Management Software of 2024 U.S. News - U.S. News & World Report

Best Property Management Software of 2024 U.S. News.

Posted: Fri, 15 Sep 2023 19:51:07 GMT [source]